Votre facture téléphone expliquée.

Tout ce que vous devez savoir sur votre facture.

La facture couvre la période allant du 10 du mois au 9 du mois suivant. Elle doit être réglée jusqu'au 28 du mois. Des frais peuvent parfois être facturés au prorata. C'est le cas lorsque vous avez souscrit ou résilié un abonnement pendant une période de facturation. C'est aussi le cas lorsque vous avez activé certaines options pendant une période de facturation et que seuls les jours utilisés sont facturés. Par exemple, si vous souscrivez un abonnement le 20 du mois, nous ne vous facturerons qu'à partir de cette date.

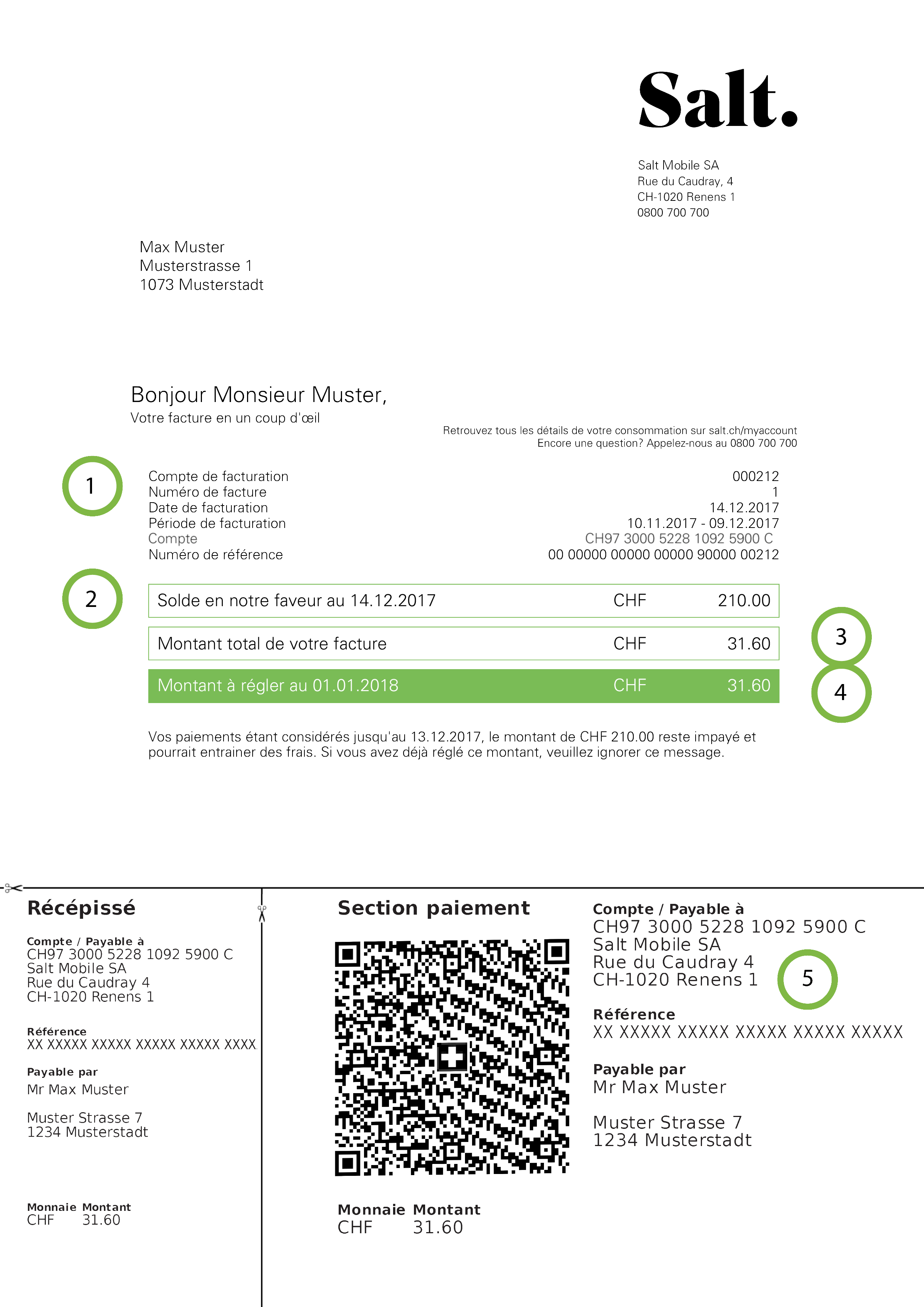

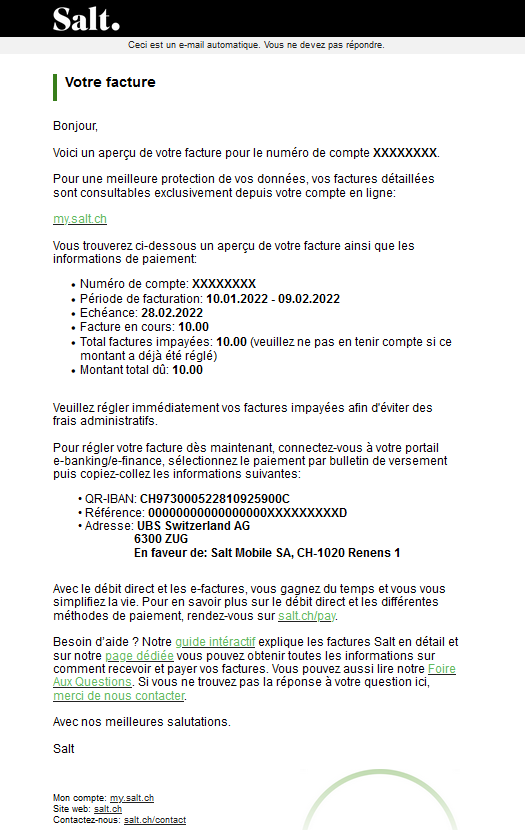

1. Dans cette section, vous trouverez votre nouveau numéro de compte de facturation. Afin de garantir une identification rapide, il s'agira désormais de votre numéro de référence unique pour toute interaction avec Salt.

2. Votre solde initial : lors de l'émission de votre facture, nous prendrons en compte tous les montants impayés et tous les paiements reçus jusqu'au 1er de chaque mois, ce qui correspond à votre solde initial. En cas de paiement anticipé ou de trop-payé, le solde sera en votre faveur et sera déduit du montant total de votre facture. En cas de retard de paiement, le solde sera en notre faveur et devra être payé immédiatement afin d'éviter des frais supplémentaires.

Important: Sur votre première facture : le montant des frais d'activation payés lors de votre commande est affiché en votre faveur dans cette section.

3. Vos frais mensuels : vos coûts pour le mois en cours (TVA incl.) sont résumés dans le montant total de votre facture.

4. Vos frais mensuels : veuillez payer le montant net facturé (surligné en vert) au plus tard le 28 de chaque mois.

5. Votre QR-facture et vos options de paiements : le montant indiqué sur votre QR-facture doit être payé le 28 du mois au plus tard. Si le solde devait rester en notre faveur, nous vous prions de le régler à l’aide de la QR-facture correspondante, en ligne par carte de crédit sur Mon Compte ou dans le Salt Store le plus proche.

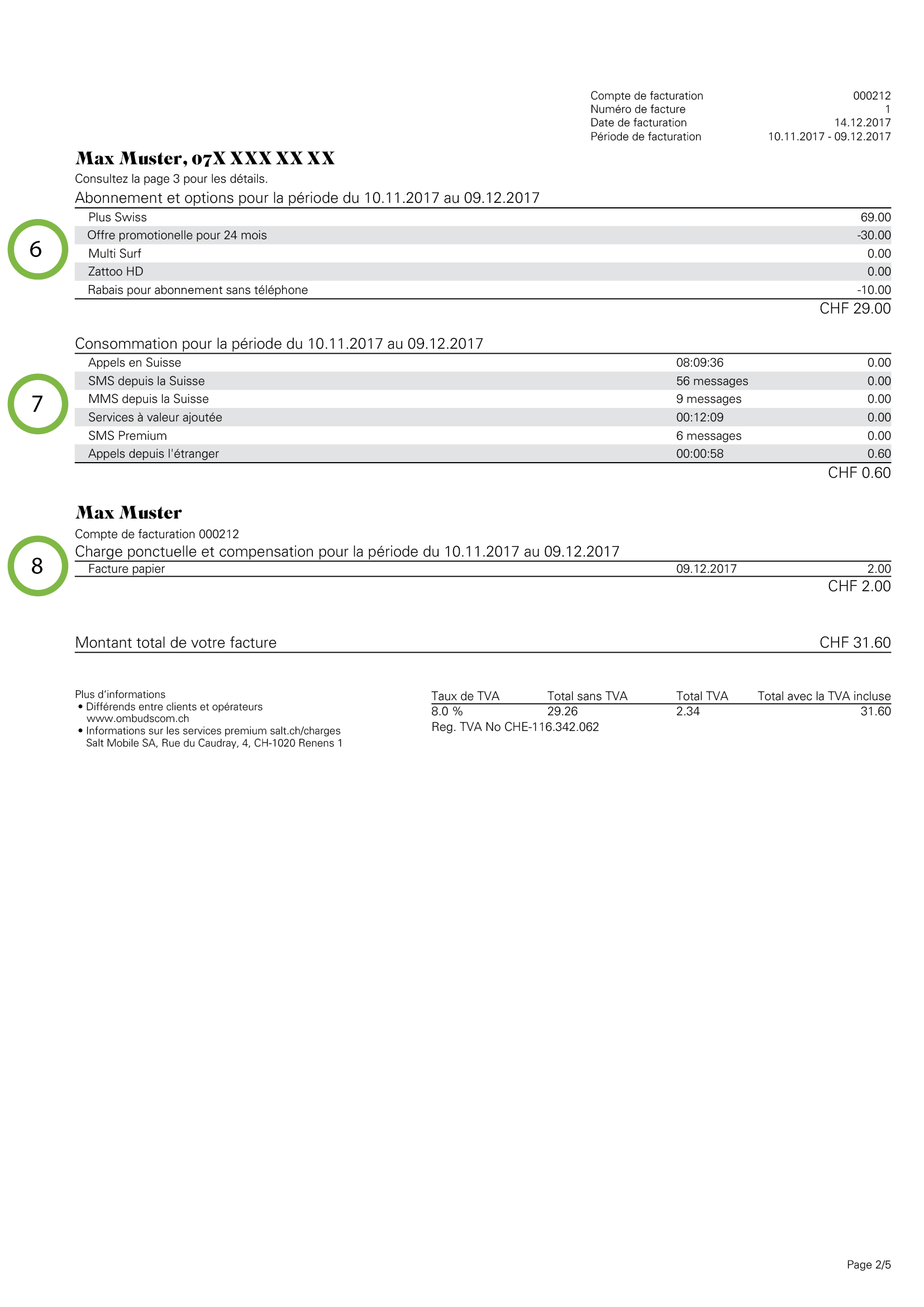

6. Abonnements et options

Vous recevrez le détail pour chacune de vos lignes, avec le nom et le numéro d'utilisateur. Votre abonnement est généralement facturé pour un mois entier.

Toutefois, si vous avez souscrit ou modifié un abonnement au cours du cycle de facturation, vous serez facturé au prorata, à l'exception de certaines options.

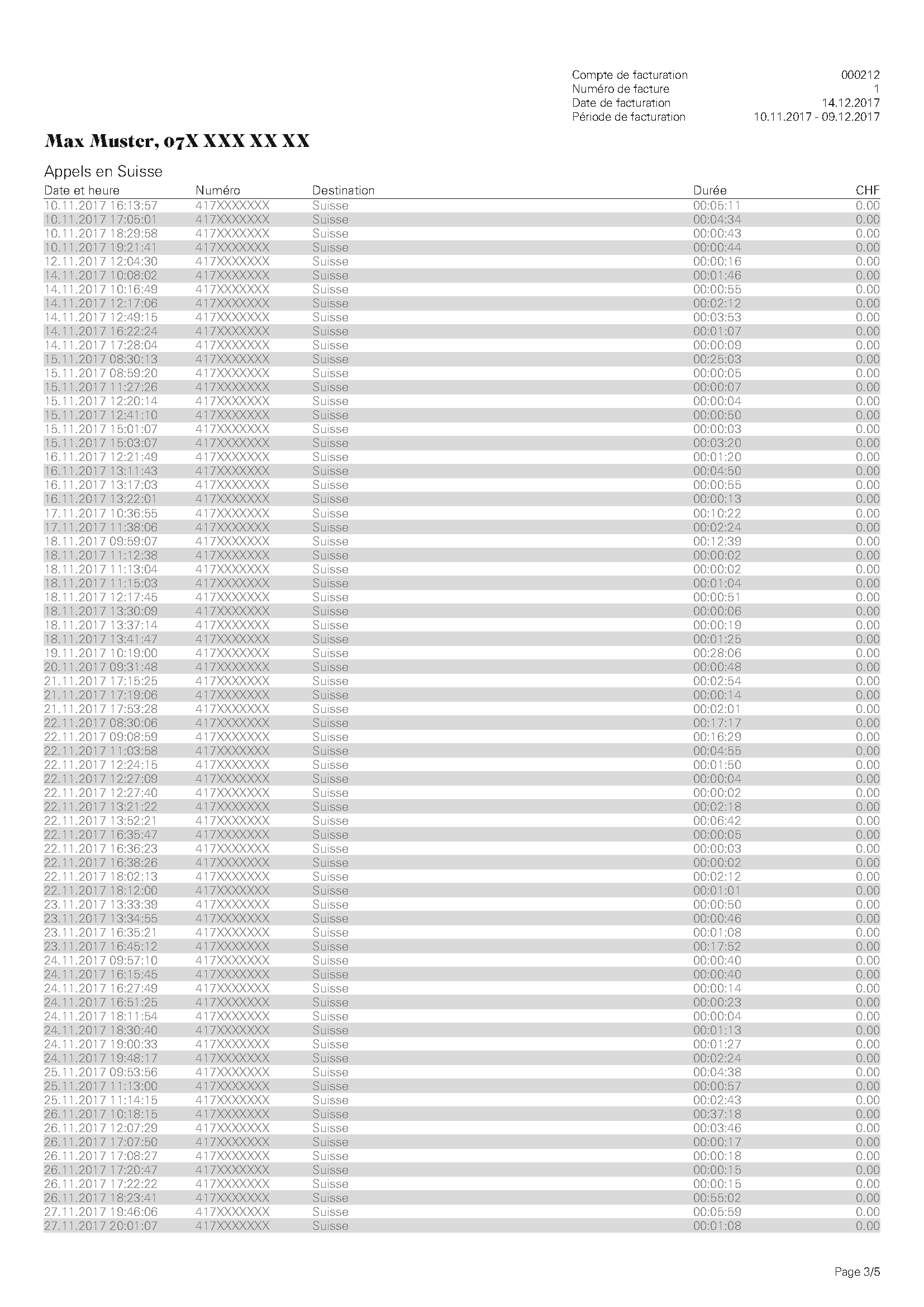

7. Votre consommation

Vous trouverez ici votre consommation mensuelle en Suisse et à l'étranger (appels, SMS, MMS, services de données et services Premium).

8. Frais uniques et compensations

Les éventuels frais ponctuels et compensations indiqués dans cette section sont ajoutés à votre compte de facturation.

Vous trouverez à la page 3 toutes les informations relatives à votre utilisation, qu'elle soit comprise ou non dans votre abonnement. Si vous recevez votre facture par e-mail, vous aurez toutes ces informations automatiquement et gratuitement. Si vous avez opté pour une facture papier, vous pouvez obtenir ces informations avec un supplément de CHF 5.– par mois.

Vous pouvez être facturé au prorata. Dans ce cas, vous n'êtes facturé pour un abonnement ou une option que proportionnellement au nombre de jours utilisés. Vous paierez donc moins que le tarif normal. Vous aurez une facturation au prorata:

- Si vous souscrivez un nouvel abonnement ou que vous ajoutez une autre option.

- Si vous modifiez votre abonnement ou passez à un abonnement supérieur.

- Si vous annulez un service.

Abonnements:

Pour le premier et le dernier mois avant le terme du contrat, la taxe mensuelle est facturée au prorata. Donc, si l'abonnement est de CHF 40.–/mois et que vous ne souscrivez qu'en milieu de mois, vous ne payerez plus que CHF 20.–.

Options exclusives:

Pour certaines options, comme Zattoo par exemple, il n'est pas possible de calculer la taxe au prorata. Ce qui signifie que vous devrez payer la totalité des frais mensuels pour le premier et le dernier mois.

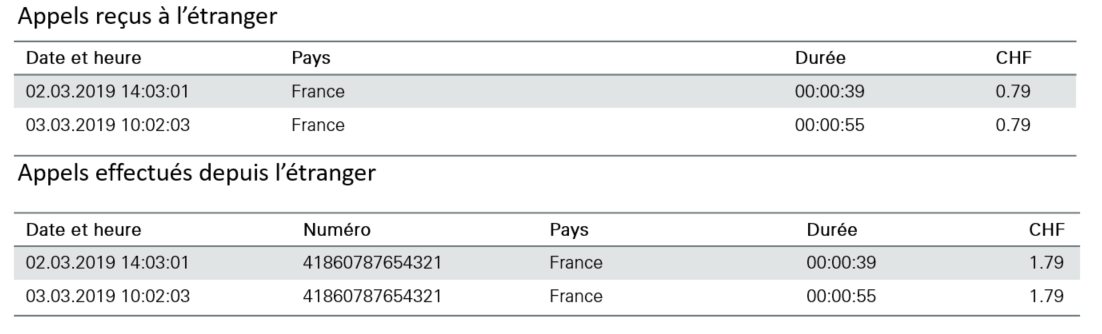

Si vous laissez votre boîte vocale activée lors de vos voyages à l'étranger, les appels en absence qui sont redirigés vers votre boîte vocale seront facturés, si vous vous trouvez dans un pays qui n'est pas inclus dans votre plan tarifaire ou si le volume des appels inclus dans votre plan tarifaire est déjà épuisé. Les frais y relatifs apparaîtront à la fois dans la section « Appels reçus à l'étranger » et dans « Appels reçus depuis l'étranger », car les appels entrants aboutissent d’abord sur votre téléphone portable à l'étranger, puis sont redirigés vers votre boîte vocale en Suisse.

Dans la section « Appels effectués depuis l’étranger », vos propres appels vers votre boîte vocale sont listés sous le numéro 418607XXXX (XXXX correspond à votre numéro de portable).

Exemple d’un abonnement n’incluant pas d’appels en roaming en France:

Si vous voulez éviter ces frais, vous pouvez ajouter une option d'itinérance (roaming) pour le pays que vous visitez (voir cette page).

Vous pouvez également désactiver votre boîte vocale lorsque vous voyagez (voir cette page).

Services à valeur ajoutée

Les numéros de service à valeur ajoutée sont utilisés par les entreprises pour fournir et facturer des services par le biais d'un numéro.

En Suisse, les services à valeur ajoutée commencent généralement par 08 ou 09 (les numéros commençant par 0800, par contre, sont gratuits).

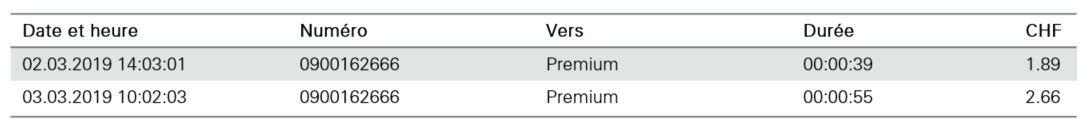

Sur la facture, les appels vers ces numéros sont affichés dans la section « Services à valeur ajoutée ».

Exemple:

Pour plus d’informations sur les services à valeur ajoutée, rendez-vous sur https://www.bakom.admin.ch/bakom/fr/page-daccueil/telecommunication/numerotation-et-telephonie/numeros-attribues-individuellement.html .

Afin de rechercher le propriétaire d'un numéro de service à valeur ajoutée spécifique, vous pouvez utiliser l'outil suivant:

https://www.eofcom.admin.ch/eofcom/public/searchEofcom_InaAllocated.do?target=doChangeLanguage .

SMS Premium

Les SMS Premium sont une bonne méthode pour payer des services spécifiques avec votre téléphone portable.

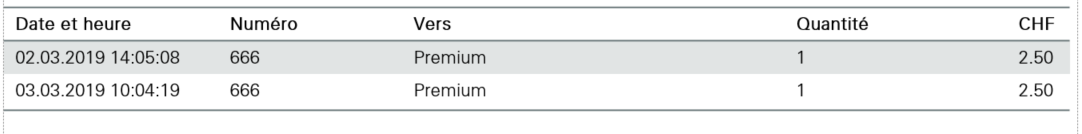

Sur la facture, ils sont affichés dans la section « SMS Premium ».

Exemple:

Cependant, si vous voulez éviter les abus coûteux, vous pouvez les bloquer. Vous pouvez bloquer les services premium et adultes en envoyant un SMS avec le contenu BLOCK ALL au numéro court 5155. Pour bloquer uniquement les services pour adultes, envoyez BLOCK ADULT au 5155.

Veuillez noter:

Ceci ne bloque que les services facturés via Salt.

Si vous envoyez BLOCK ALL, vous ne pourrez plus utiliser votre téléphone pour payer certains services (p. ex. Selecta, parking tickets, etc.).

Ces SMS ne sont pas envoyés par Salt mais par un fournisseur de services. Vous pouvez utiliser notre outil de recherche sur les numéros courts afin de trouver le nom du fournisseur de services en question.

Les factures par e-mail vous arrivent plus rapidement, détaillent entièrement votre utilisation, sont gratuites et peuvent être payées en ligne.

Les frais pour services additionnels, que vous pouvez voir sur votre facture, sont expliqués ci-dessous.

| Carte SIM | CHF 59.95 pour une nouvelle carte SIM |

| Facture papier (résumée) | CHF 2.95 par facture |

| Facture papier (détaillée) | CHF 5.- par facture |

| Frais de rappel | CHF 30.- pour le premier rappel et jusqu’à CHF 75.- pour chaque rappel subséquent |

| Frais de suspension | CHF 50.- par compte Salt |

| Frais de paiement | CHF 4.45 par paiement BVR au comptoir de la Poste |

| Frais de paiement de facture | CHF 4.95 par paiement effectué auprès de notre Service Clientèle |